- 00Hours

- 00Minutes

- 00Seconds

- Date : 15 January, 2025

- Time : Depends on the availability of student

- Location : Online Classes

This course is designed to equip you with the skills needed to excel in the financial industry. Whether you’re a beginner, a professional looking to upskill, or an entrepreneur seeking financial knowledge, our program covers everything from the basics to advanced financial strategies.

Product @ Paytm | Analytics Team Lead | Ex-SDE at Service Brands Tech, Canada | Judge/Mentor/Speaker at 10+ Hackathons | Data Science & GenAI

AI Engineer | Data Analyst | Power BI | Tableau | Python | Machine Learning | Generative AI

SDE-2 @ Shipbob | Ex - SDE @ Amazon | SDE Intern'22 @ Amazon | CSE MMMUT'22

SWE II @ Cisco

Basic knowledge of financial concepts and familiarity with Excel or similar tools are recommended. No advanced prerequisites are required.

This course is ideal for students aiming to start a career in finance, professionals seeking to enhance their financial expertise, mentors and trainers looking to advance their knowledge, and entrepreneurs who want to master financial management.

Topics include financial markets, asset classes, financial statements, company and industry analysis, valuation methods, macroeconomic factors, technical analysis, trading strategies, risk management, portfolio construction, and behavioral finance.

The course typically spans 6-8 weeks, depending on your pace, including lectures, assignments, and hands-on projects.

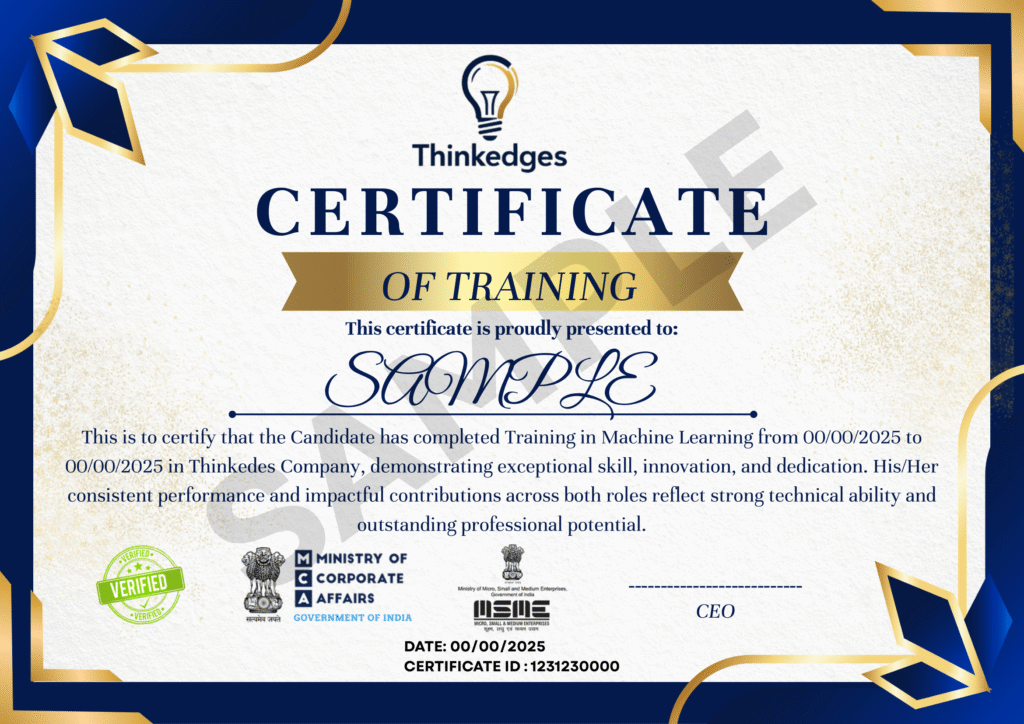

Yes, you will receive a certificate of completion and a Letter of Recommendation upon successfully finishing the course and all required assignments and projects.

Empowering learners with industry-ready skills, practical knowledge, and hands-on learning experiences that prepare them to excel, innovate, and build a successful future in the digital world.

We prioritize your privacy by securely handling personal data, using it only to improve your learning experience. All information shared with us is protected with strict safeguards.

Don’t miss out on our biggest sale of the year. Join our course and achieve your dreams.

Don’t miss out on our biggest sale of the year. Join our course and achieve your dreams.

Don’t miss out on our biggest sale of the year. Join our course and achieve your dreams.